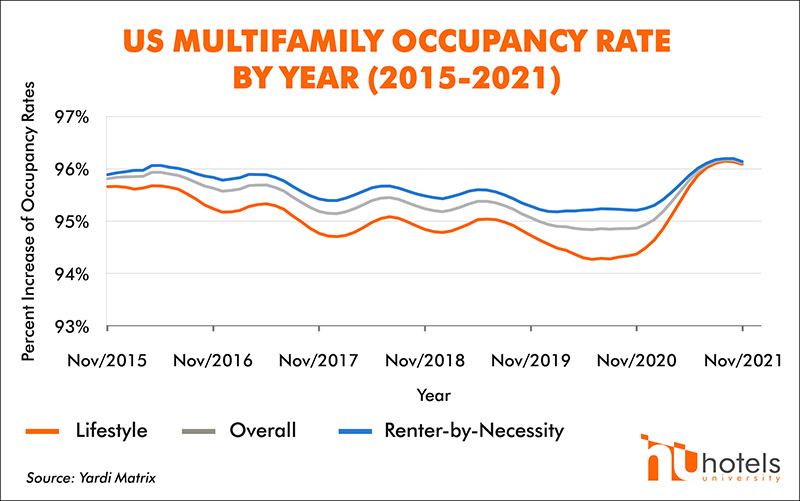

Demand for apartments remains strong, and the national occupancy rate has been at or near record highs for the last six months. The apartment market experienced robust growth in 2021. Last week we talked about how the demand for market-rate apartments in 2021 soared far above the highest levels on record. Now, the multifamily market continues to be one of the more appealing property developments in the real estate market. Read on!

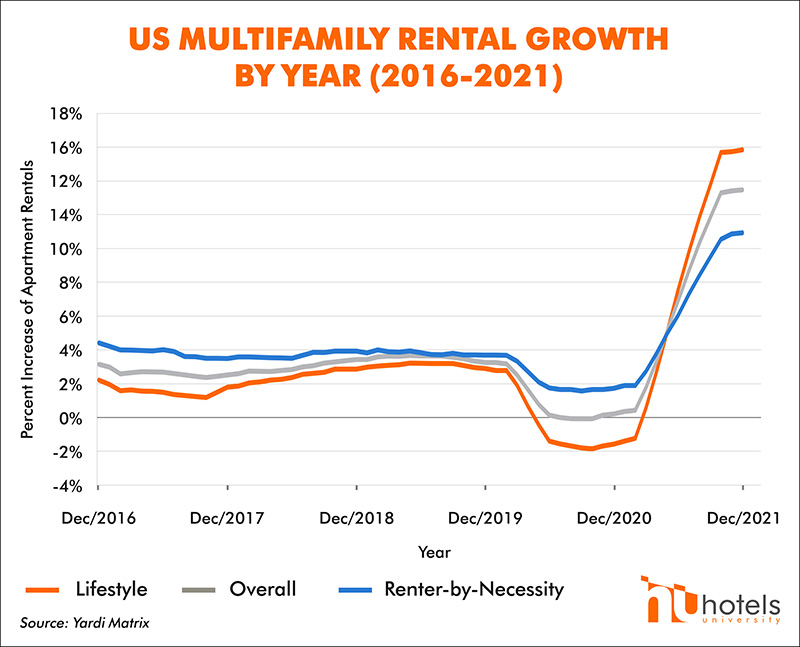

According to Yardi Matrix’s survey, the annual rent growth of 13.5% was more than double any previous year, and apartment concentration counted nearly 600,000 units, which is approximately 50% more than the previous annual high set in 2015. It’s an easy call to forecast moderation in rent increases, but it’s predicted that the overall US rent growth will reach 4.8% in 2022, well above the long-term 2.7% average.1

The number of occupied units hit record levels in 2021. Concerns about oversupply have become moot, and builders are ramping up projects. As of the beginning of 2022, more than 750,000 market-rate apartment units were under construction.

Multifamily capital conditions could not be more favorable.

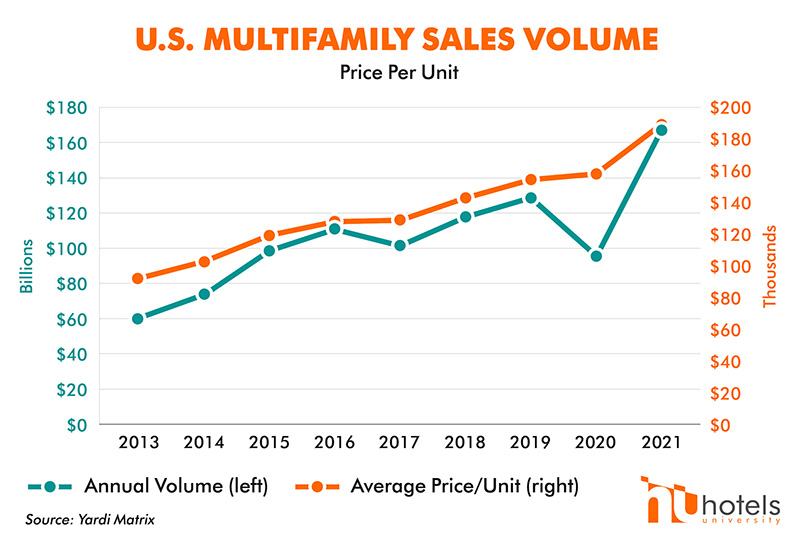

Did you know: Some $166 billion of multifamily transactions were completed in 2021, up 75% from 2020. Debt availability is also robust, led by Fannie Mae and Freddie Mac, which have increased capital allocations in 2022.

Price per unit also reached an all-time high at $188,000, surpassing the previous high of $157,000 in 2020.

BASE4 | Multifamily Experts

You need design partners who understand how to create efficient and high-quality living spaces with affordable construction options from coast to coast. Our designers will help you achieve your project’s goals. We help developers, general contractors, and factories find better and cheaper ways to build through innovative technology, forward-thinking design, and offsite manufacturing.

Thank you,

Blair Hildahl

Blair@hotelsuniversity.com

608.304.5228

Leave A Comment